All Categories

Featured

If you're mosting likely to use a small-cap index like the Russell 2000, you might want to stop and take into consideration why an excellent index fund firm, like Vanguard, doesn't have any kind of funds that follow it. The factor is since it's a poor index. In addition to that changing your entire plan from one index to an additional is barely what I would certainly call "rebalancing - what is difference between whole life and universal life insurance." Cash worth life insurance policy isn't an attractive possession class.

I haven't also dealt with the straw guy below yet, and that is the reality that it is relatively uncommon that you in fact have to pay either taxes or significant commissions to rebalance anyway. I never have. Many smart capitalists rebalance as high as possible in their tax-protected accounts. If that isn't rather adequate, early accumulators can rebalance totally making use of brand-new payments.

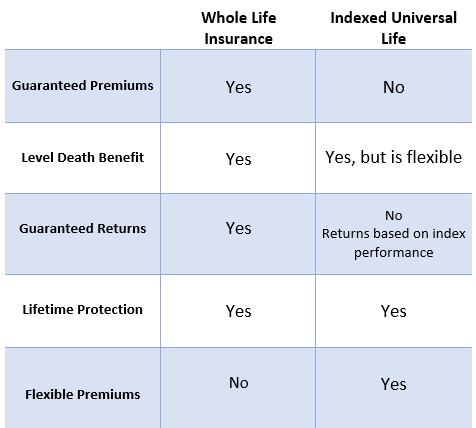

Universal Life Insurance Comparisons

And of program, nobody must be getting loaded mutual funds, ever before. It's really too poor that IULs don't work.

Latest Posts

Allianz Indexed Universal Life

Fixed Indexed Life Insurance

Principal Group Universal Life